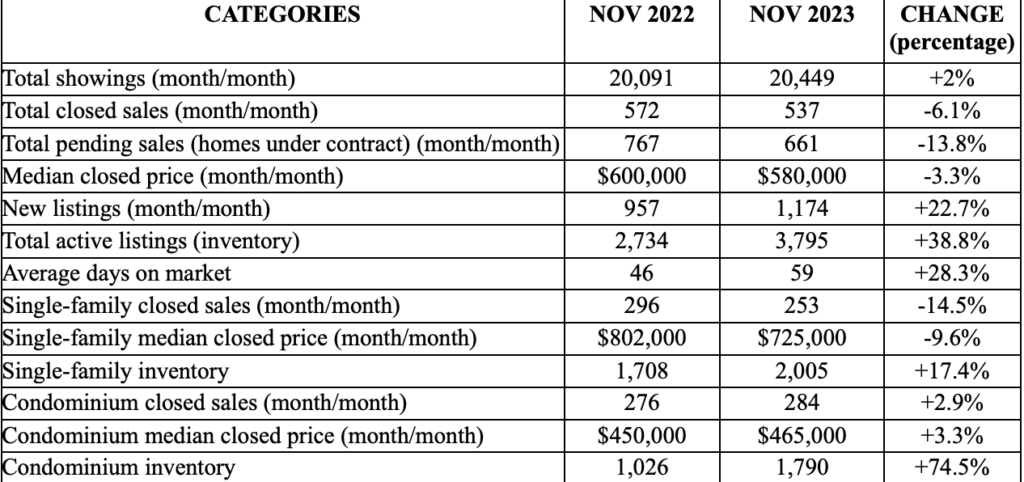

Inventory increases while home prices decline in November.

Naples, Florida – As of December 26, 2023 The total number of residential properties in Naples rose by 38.8 percent in November, from 2,734 in November 2022, to 3,795. There has been a lack of selection for purchasers since September 2020. Additionally, there were 1,080 price reductions during the month, which led to a decline of 3.3 percent in the aggregate median closed price. Data from the November 2023 Market Report by the Naples Area Board of REALTORS® (NABOR®), which monitors home listings and sales in Collier County (excluding Marco Island), indicated that the housing market is positioned for robust winter sales. However, the extent of this outlook is contingent on two factors: the persistence of sellers in setting competitive prices for their properties and the confidence of buyers in the viability of the investment.

The November Report revealed the highest number of price reductions in six months, 1,080. There appears to be evidence of price deceleration in certain areas of Naples, as the aggregate median closed price decreased from $600,000 in November 2022 to $580,000. November, therefore, was one of four months in which median closed prices decreased this year. Indeed, there has been a lack of reported year-over-year price reductions since 2019.

The number of pending sales (contract residences) experienced a decline of 13.8 percent in November, falling from 767 in November 2022 to 661. Additionally, there was a decline of 6.1 percent in closed sales, which dropped from 572 to 537. In light of this information, broker analysts who were examining the November report speculate whether the Federal Reserve’s commitment to reduce interest rates in 2024 is deterring certain buyers.

In addition to an overall market summary, the NABOR® November 2023 Market Report compares single-family home and condominium sales (via the Southwest Florida MLS), price ranges, and geographic segmentation. Chart-formatted NABOR® sales statistics for 2023 include the following findings for the entire market (single-family and condominium properties):

While monthly inventory levels for single family and condominiums typically increase and decrease in a

similar manner, inventory in the condominium home market in November rose by 74.5 percent compared

to a 17.4 percent increase in the single family home market. Brokers reviewing the report said the rise in

condominium inventory was most likely due to obstacles that prohibited sellers from listing their

condominiums if it or the property encountered hurricane damage last year.

In 2021 and 2022, when inventory and interest rates were incredibly low, there was more urgency to buy a home. In 2023, interest rates, property insurance rates, and property taxes rose, making the cost of

maintaining or keeping a home in Florida prohibitive for many homeowners.